ACQUISITION PRICE DONOR PLUS PERMANENT EXPENSE DONOR

A 3 donor is also a voter at worst and perhaps a volunteer or district captain. Organ acquisition costs include the reasonable and necessary services to acquire an organ living and deceased for transplant.

Accy 405 Final Flashcards Quizlet

There are two diverging opinions on what that term entails.

. We must solicit from existing donors while simultaneously growing prospect lists and converting new leads into first-time donors. ACCOUNTING FOR THE COST OF ORGAN ACQUISITION. So while the cost of direct mail acquisition may range from 100 to 125 per dollar raised once new donors have been identified a second mailing to that group may cost only 020 per dollar raised.

Higher Costs to Acquire Donors Versus Retaining Them. Provide the standard kidney acquisition charge on revenue code 081X. One gift of 70000 is restricted by the donor so that it cannot be spent for four years.

Separately by revenue code 0811 Acquisition of Body Components Living Donor or 0812. Donor acquisition and donor retention are very closely connected. The standard charge for acquiring a cadaver kidney.

The adjusted basis of the donor plus the cost for any improvements or additions minus any. As a consequence the recipient who received a gift from a donor who is a citizen shall be deemed to acquire the asset at an acquisition price equal to the acquisition price paid by the donor. And of course they may be able to give more in the future.

The medical costs related to the donation procedure are also covered by this fee. It may seem like the best way to get donations is by acquiring more donors. It has been proposed to remove the period of five years condition in the current provision.

While acquiring donors is a great way to expand your donor base and boost giving retaining your existing donors is just as important and often costs less money than attracting new donors. From the initial acquisition campaign charities should expect an average return-on-investment of approximately 050 and most acquisition efforts should break even within 1824 months. Even the largest companies that have seemingly saturated their markets need to bring in new business.

Of Donors Acquired. In some instances the actual itemized bill for the donor. And b The recipient is deemed to acquire the asset at a deemed acquisition price equal the acquisition price paid by the donor plus permitted expenses incurred by the donor.

Donor acquisition is challenging but far less so when you work the process above. Organ acquisition costs for heart kidney liver lung pancreas and intestinalmulti-visceral. These outpatient services include donor and recipient work furnished prior to admission and costs of services rendered -ups.

The cost of the asset plus any permanent improvements or additions minus any casualty loss or depreciation that is claimed on the donors tax return. If the donor is a Malaysian citizen. When asked by organizations whether their online fundraising programs should focus on donor acquisition or donor retention I say Yes As fundraisers we dont have the option of choosing.

Donor acquisition can be calculated through the following formula. MLN Matters MM11087 Related CR 11087 Page 2 of 3 Acquisition of Body Components Cadaver Donor and are not included in the DRG-based payment for the. Medicare is the single largest payer for organ acquisition costs but only reimburses for its share of costs.

Billing for Kidney Acquisition Live Donor and Cadaver Donor. It seems straightforward at first but theres a catch when it comes to calculating the total costs portion of the formula. Use type of bill TOB 11X.

Outpatient Costs--Included in the CTCs organ acquisition costs are hospital services classified as outpatient and applicable to a potential transplantorgan. These charges are not considered for the IPPS outlier calculation when a procedure code beginning with 556 is. The cost to continually acquire new donors can easily run 50 to 100.

Acquisition by the donor the recipient shall be deemed to have received the gift at its market value. Part 6 of our series The Perfect Fundraising Plan will be available soon. There are many other ways to acquire new donors.

Most studies agree it costs 10 times as much for a nonprofit to bring in new donors as it does to keep current ones. In 2016 Medicare reimbursed CTCs 16B of approximately 33B 48 claimed through the Medicare Cost Report. In situation the donor is not a citizen or permanent resident of Malaysia gift to close family member with the relationship of husband and wife parent and child or.

How to Calculate Donor Acquisition Costs. This trend is similar to whats seen in the for-profit sector. Remember that after you acquire loyal donors youll need a donor managment system to retain them.

For the receiver if the gift is made within five years after the date of acquisition by the donor the recipient shall be deemed to acquire the asset at an acquisition price equal to the acquisition price paid by the donor plus the permitted expenses incurred by. Ultimately some of these donors. Plus donor acquisition is costly.

A 2700 donor is these things plus someone who may be able to attract like-minded funders at a max level. New donor acquisitions should always be an investment. Donor acquisition isnt a one-and-done process and is constantly evolving but with careful planning and execution your nonprofit can reap the benefits of having new donors.

The first believes that. Thus for example if youre spending 800 per thousand pieces of mail and getting a 1 response with a 20 average gift that part of the acquisition process has so far cost 60 per new donorlead 800 minus 200 in income 600 divided by 10 donorsleads -60 each. The value of a name in political spheres far exceeds just their donation value.

Did you know it takes an average of two years to break even on donor acquisition costs. RM000 Zainals acquisition price for the cocoa estate 200 permitted expenses incurred by him-----200 - money payment-----200-----Since Zainal did not pay for the cocoa estate but obtained it on 142014 from his father as a gift he is deemed to acquire it at his fathers acquisition. 8000 sales price - 7000 basis no loss.

The acquisition price for the shares would be. The third concept might truly ring home with any CFO of your charity because the cost savings happen in the short term whereas the major gift and lifetime value concepts take years to illustrate the return on investment. The actual donation surgery expense is covered by the recipients insurance.

5A private not-for-profit entity receives three large cash donations. The transplant center will charge a recipients insurance an acquisition fee when he or she receives a transplant. These are not the only things you can do to attract new donors but I think of them as the basic foundation necessary to grow any fundraising program.

Initial basis in purchased property is. Donor Acquisition Cost Total CostsTotal no. One gift of 90000 is restricted to pay the salaries of the entitys workers.

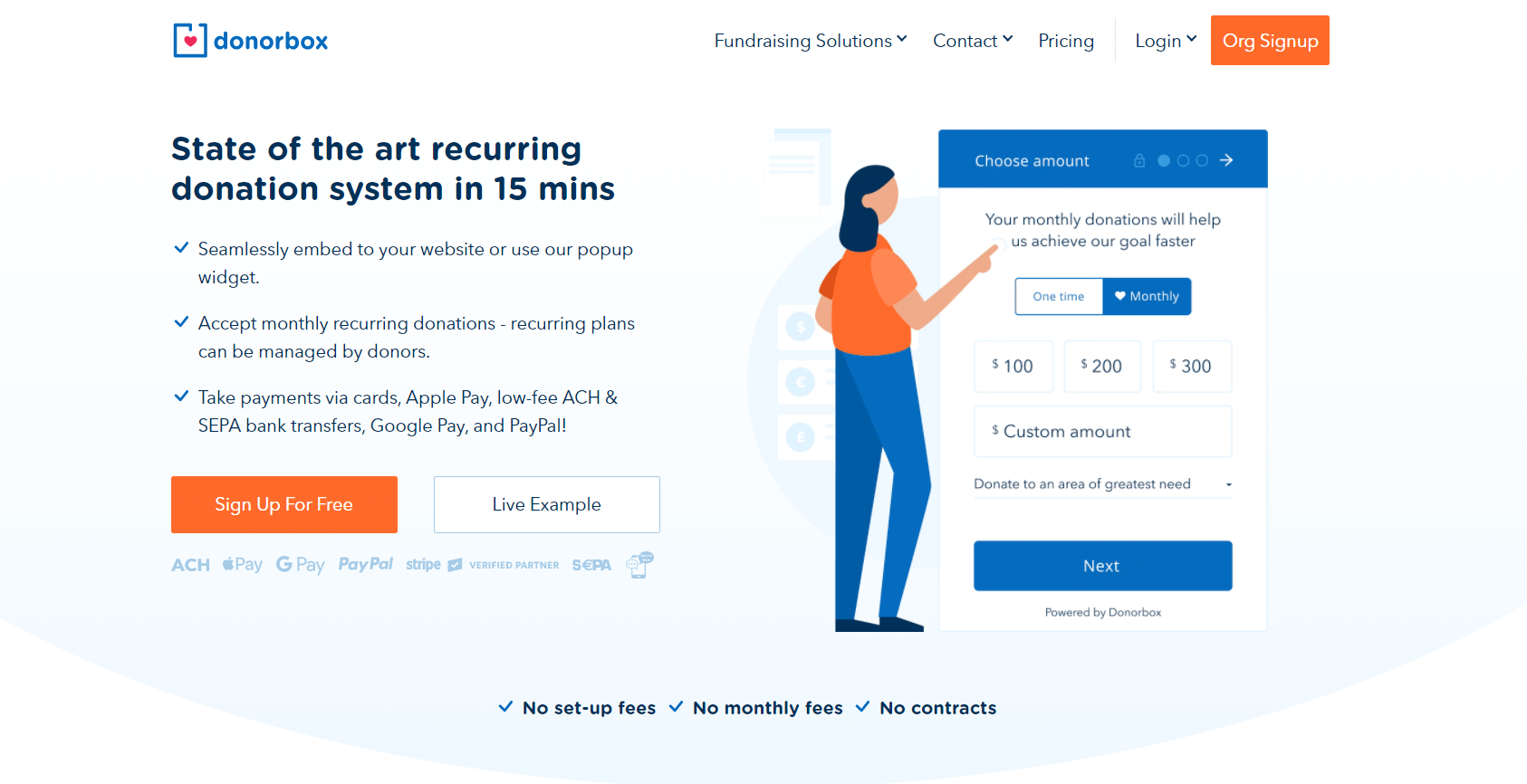

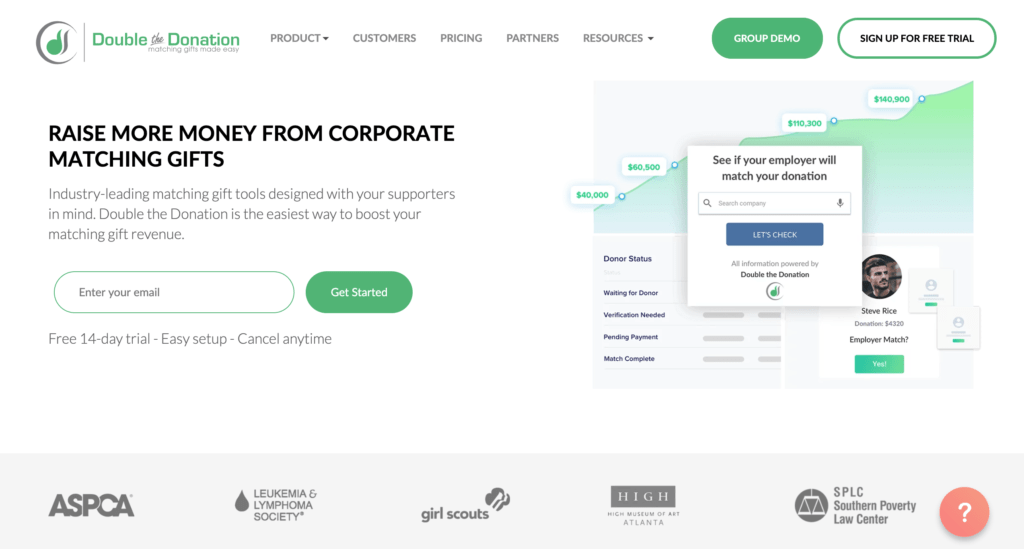

Top 10 Donation Software That Help Nonprofits Online Donation Tools

Top 10 Donation Software That Help Nonprofits Online Donation Tools

Factors Associated With Consent For Organ Donation A Retrospective Population Based Study Cmaj

Top 10 Donation Software That Help Nonprofits Online Donation Tools

![]()

Definition Of Data Migration Data Management Glossary Komprise

Top 10 Donation Software That Help Nonprofits Online Donation Tools

0 Response to "ACQUISITION PRICE DONOR PLUS PERMANENT EXPENSE DONOR"

Post a Comment